Scenario Consolidation Settings

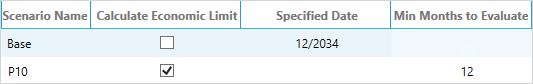

The Scenario Consolidation Settings table, located on the Settings tab, allows you to configure economic limit calculation, and also scenario weighting. Any scenarios that you add to a project will also be displayed here (see Add a scenario).

Economic Limit

The economic limit date can be calculated automatically or set to a particular date.

Note: If Calculate Economic Limit is checked, the limit will be triggered depending on the regime settings. For example, it can be based on the maximum cumulative before tax cash flow. After the limit is reached, it will not generate any results in the calculations except for delayed abandonment and tax payments.

Minimum months to evaluate

The Min months to evaluate setting allows you to set the minimum number of months for evaluation before the economic limit can be reached. This can be used, for example, when a drilling program has a set time for completion before it can be abandoned.

Important: The economic limit date is rounded according to the periodicity of the regime under which the project is created. For example, if you enter 4 in the Min months to evaluate field but the regime periodicity is semi-annual, the economic limit will be calculated based on 6 months of data.

'Is Failure Scenario' setting

Checking Is Failure Scenario for a scenario will mark it is as a failure scenario. This is used when Economics data are imported to Planning Space Portfolio for risk analysis.

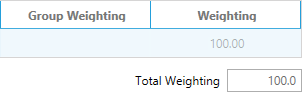

Scenario Weightings

If your project contains several scenarios, you can specify their weightings in the Scenario Consolidation Settings table. Project weightings apply a factor (specified as a percentage) to the project results. For example, an exploration project might have a success scenario weighted at 70% (chance of success), and a dry hole scenario weighted at 30% (chance of failure). Weightings are applied when you calculate the project. They can range from -100,000 to 100,000 and the total weighting can exceed 100%.

Project weightings are commonly used to generate an Expected Monetary Value (EMV) using low, base and high scenarios, which are combined using a Swanson's Mean (i.e., with the weightings 30, 40, 30), or another choice of weightings. They can also be used to generate risked results for dry hole or fail case scenarios.

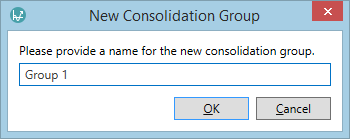

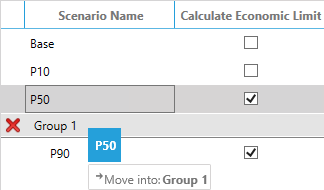

Consolidation Group

You can also add consolidation groups, which group scenarios together. This will allow you to set a group weighting that is evenly distributed across all scenarios within the group.

Click the Add Group button to open the New Consolidation Group dialog. Enter a name for the group and click OK.

You can then drag and drop scenarios within the Scenario Consolidation Settings table into the group. To evenly distribute a weighting across them, enter a value in the Group Weighting field.

To delete a group, click the  button next to its name.

button next to its name.